The Central Bank was told to provide clarification on legal advice they had received that allowed them to pay up to half a million euro in top-ups to a select group of staff as “retention payments”.

They were also told that if advance legal advice had not been received allowing the payments, they would have to take steps to recover the money from the workers who had benefitted under a controversial bonus scheme.

In correspondence with the Department of Public Expenditure, a series of questions were raised about the retention payments, which were described as “large [but] ineffective”.

In an email exchange within the Department, a senior civil servant wrote that only three staff had actually stayed long enough in their jobs at the Central Bank to collect the full top-up.

The email also explained how the Central Bank had not received “advance legal advice” and were facing queries from the Comptroller and Auditor General about the payments.

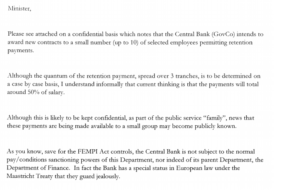

The top-ups have been heavily criticised because bonus and performance-related payments were expressly forbidden under the FEMPI legislation introduced right across the public service to deal with the financial crisis.

However, the Central Bank — unlike all other state bodies — did not have to seek express sanction from the Department of Public Expenditure for payments.

According to a memo for then minister Brendan Howlin, which was obtained under FOI, this was because there was a provision under the Maastricht Treaty, which gave them a special status that they “guard jealously”.

That memo also explained how the payments were to be “kept confidential”, but expressly warned that “news that these payments are being made available to a small group may become publicly known”.

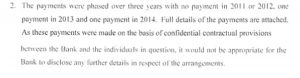

The retention payments did become public and were the subject of a flurry of correspondence after the payments, which then totalled around €234,000, were criticised at the Public Accounts Committee last November.

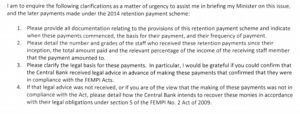

In a letter sent to the Central Bank late last year, the Department of Public Expenditure demanded all documentation relating to the scheme along with the names and amounts paid to each individual.

In response, the Central Bank said that “retention payments” had been sanctioned for eight employees in May 2011 amid concerns these staff could be tempted into the private sector by better pay.

The bank refused to provide the names of the individuals who received the payments on the “basis of confidential contractual provisions”.

It also said: “Specific legal advice were not obtained at the time but we have since consulted with our external legal advisers and, based on the advices received, we are satisfied that the Bank had a valid and legal basis for making the payments at the time.”

An internal Department email commented: “No advance legal notice, but a general assertion that the payments were compatible with the purpose of FEMPI, as opposed presumably to the strict letter of it.”

The Department responded to the Central Bank again seeking confirmation that they had legal advice that the payments were in compliance with law.

“In the absence of such advice, or agreement, I would be grateful if you could detail what steps will be taken on behalf of the Bank to recover monies paid to employees,” it said.

In a further short email response, the Central Bank said: “I stated in my [previous] letter … that the Bank had received legal advice in respect of the 2011 retention payments and the Bank was satisfied, on the basis of that advice, that the Bank has a valid and legal basis for making the retention payments at the time.”

The Central Bank said they were satisfied the payments were in order and that there was “no question of repayment of funds”.

A statement said: “This policy was developed in response to the Bank’s risk of losing key employees who are in certain strategic roles critical to strategically significant projects.”

The Department of Public Expenditure said they had nothing to add.

Two sets of documents below on the discussions for those interested (redactions of personal email addresses and mobile phone numbers are mine):

Loading...

Loading...

Loading...

Loading...